Save tax, elevate your financial well-being

Dive into a tax-free haven with our expertly crafted trusts

Success in business and protecting wealth require thoughtful tax planning due to unpredictable economic conditions and complex regulations. Setting up an offshore trust can aid planning, helping owners and individuals minimize taxes while maintaining control over assets. Offshore trusts in low-tax jurisdictions provide a strategic option for navigating challenges and uncertainties when managing businesses, investments, and legacies internationally.

Unleash the Power of Tax-Smart Management Tools

Fear of losing your wealth to hefty taxes?

Ensure your legacy reaches your loved ones tax-free and creditor-proof? Trust, your tax-saving savior.

01

Income Tax Deferral and Avoidance

By placing income-producing and appreciating assets in an appropriately structured trust, you can shift tax liability to trust beneficiaries in lower tax brackets.

01

Income Tax Deferral and Avoidance

By placing income-producing and appreciating assets in an appropriately structured trust, you can shift tax liability to trust beneficiaries in lower tax brackets.

01

Income Tax Deferral and Avoidance

By placing income-producing and appreciating assets in an appropriately structured trust, you can shift tax liability to trust beneficiaries in lower tax brackets.

01

Income Tax Deferral and Avoidance

By placing income-producing and appreciating assets in an appropriately structured trust, you can shift tax liability to trust beneficiaries in lower tax brackets.

02

Estate Tax Savings

02

Estate Tax Savings

02

Estate Tax Savings

02

Estate Tax Savings

03

Tax-Free* Income Distributions

03

Tax-Free* Income Distributions

03

Tax-Free* Income Distributions

03

Tax-Free* Income Distributions

04

Capital Gains Taxes Deferral and Avoidance

04

Capital Gains Taxes Deferral and Avoidance

04

Capital Gains Taxes Deferral and Avoidance

04

Capital Gains Taxes Deferral and Avoidance

*Tax treatment can depend on the settlor and beneficiary's specific tax jurisdiction, so results may vary.

How it works?

Steps on how trusts can shield your assets from taxes and optimize your tax structure.

Trust set up

Create a trust account on Asia's first UTGL fintech trust platform and choose a trust plan that fits your goals. Documents are legally binding once signed.

Fund the trust

Fund your trust by transferring eligible assets. Options include cash, securities, real estate, digital assets, and more.

Use your trust

Qualified distributions to beneficiaries may be tax-exempt depending on structure. Asset sales inside the trust can defer capital gains taxes.

Noteworthy reads

Articles to help you make the most of your money

Why Tax Planning with UTGL

Asia's pioneering one-stop fintech trust platform

allows you to centralize various types of assets managed by licensed trust company

Asia's pioneering one-stop fintech trust platform

allows you to centralize various types of assets managed by licensed trust company

Asia's pioneering one-stop fintech trust platform

allows you to centralize various types of assets managed by licensed trust company

Asia's pioneering one-stop fintech trust platform

allows you to centralize various types of assets managed by licensed trust company

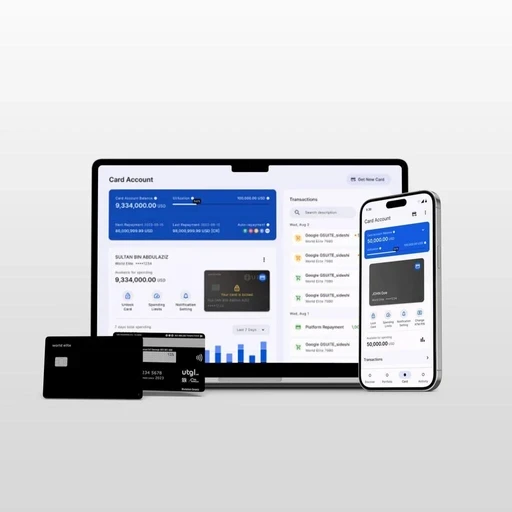

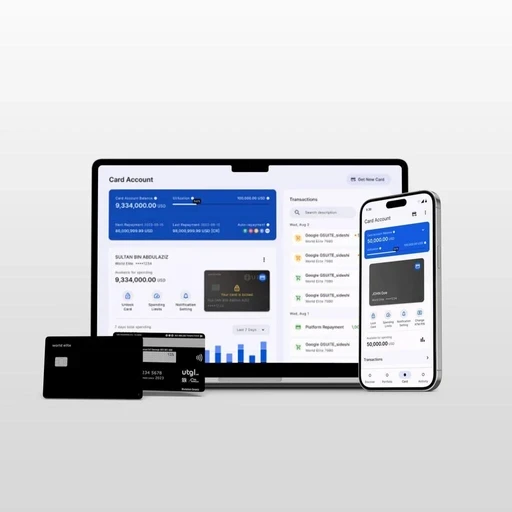

Pioneering Trust Asset Link credit card

ensuring consumer privacy, providing self-regulated credit limits, and simplifying the repayment process

Pioneering Trust Asset Link credit card

ensuring consumer privacy, providing self-regulated credit limits, and simplifying the repayment process

Pioneering Trust Asset Link credit card

ensuring consumer privacy, providing self-regulated credit limits, and simplifying the repayment process

Pioneering Trust Asset Link credit card

ensuring consumer privacy, providing self-regulated credit limits, and simplifying the repayment process

Default multiple offshore bank accounts

connecting with multiple globally compliant financial institutions worldwide.

Default multiple offshore bank accounts

connecting with multiple globally compliant financial institutions worldwide.

Default multiple offshore bank accounts

connecting with multiple globally compliant financial institutions worldwide.

Default multiple offshore bank accounts

connecting with multiple globally compliant financial institutions worldwide.

Retaining investment rights and flexible utilization of trust assets

One-click access to global investment tools, seize global investment opportunities anytime, anywhere

Retaining investment rights and flexible utilization of trust assets

One-click access to global investment tools, seize global investment opportunities anytime, anywhere

Retaining investment rights and flexible utilization of trust assets

One-click access to global investment tools, seize global investment opportunities anytime, anywhere

Retaining investment rights and flexible utilization of trust assets

One-click access to global investment tools, seize global investment opportunities anytime, anywhere

Adopting a progressive and user-friendly fee model

breaking the barriers and complexities of traditional trust structures in an innovative way

Adopting a progressive and user-friendly fee model

breaking the barriers and complexities of traditional trust structures in an innovative way

Adopting a progressive and user-friendly fee model

breaking the barriers and complexities of traditional trust structures in an innovative way

Adopting a progressive and user-friendly fee model

breaking the barriers and complexities of traditional trust structures in an innovative way

With over 20 years of group development

UTGL possesses extensive financial experience and a team of professionals in finance, law, technology, and accounting, demonstrating strong capabilities

With over 20 years of group development

UTGL possesses extensive financial experience and a team of professionals in finance, law, technology, and accounting, demonstrating strong capabilities

With over 20 years of group development

UTGL possesses extensive financial experience and a team of professionals in finance, law, technology, and accounting, demonstrating strong capabilities

With over 20 years of group development

UTGL possesses extensive financial experience and a team of professionals in finance, law, technology, and accounting, demonstrating strong capabilities

Choose Your Plan

Standard

$120 application fee or

$0*

*Injection over $10,000

Premium

$360 application fee or

$0*

*Injection over $30,000

Supreme

$15,000 application fee or

$0*

*Injection over $500,000

*Injection $500,000+

Create an impregnable "firewall" to protect all types of your assets for yourself and future generations, while enjoying exceptional services.

Frequently Asked Questions

What is trust?

A trust is a legal arrangement in which an individual, known as the settlor, transfers ownership of their assets to a trustee, who is responsible for managing and distributing the assets according to the terms of the trust. Trusts can be used for a variety of purposes, including estate planning, asset protection, and wealth management.

What is trust?

A trust is a legal arrangement in which an individual, known as the settlor, transfers ownership of their assets to a trustee, who is responsible for managing and distributing the assets according to the terms of the trust. Trusts can be used for a variety of purposes, including estate planning, asset protection, and wealth management.

What is trust?

A trust is a legal arrangement in which an individual, known as the settlor, transfers ownership of their assets to a trustee, who is responsible for managing and distributing the assets according to the terms of the trust. Trusts can be used for a variety of purposes, including estate planning, asset protection, and wealth management.

What is trust?

A trust is a legal arrangement in which an individual, known as the settlor, transfers ownership of their assets to a trustee, who is responsible for managing and distributing the assets according to the terms of the trust. Trusts can be used for a variety of purposes, including estate planning, asset protection, and wealth management.

Who can set up a trust?

Anyone can set up a trust, as long as they are of legal age and have the mental capacity to do so. Trusts can be set up by individuals or businesses, and they can be created for a variety of purposes.

Who can set up a trust?

Anyone can set up a trust, as long as they are of legal age and have the mental capacity to do so. Trusts can be set up by individuals or businesses, and they can be created for a variety of purposes.

Who can set up a trust?

Anyone can set up a trust, as long as they are of legal age and have the mental capacity to do so. Trusts can be set up by individuals or businesses, and they can be created for a variety of purposes.

Who can set up a trust?

Anyone can set up a trust, as long as they are of legal age and have the mental capacity to do so. Trusts can be set up by individuals or businesses, and they can be created for a variety of purposes.

Who can be a beneficiary of a trust?

Beneficiaries of a trust are the individuals or organizations who are entitled to receive the assets and income of the trust. Beneficiaries can be named in the trust document, or they can be designated by the settlor at a later date. Beneficiaries can include family members, friends, charities, or other organizations.

Who can be a beneficiary of a trust?

Beneficiaries of a trust are the individuals or organizations who are entitled to receive the assets and income of the trust. Beneficiaries can be named in the trust document, or they can be designated by the settlor at a later date. Beneficiaries can include family members, friends, charities, or other organizations.

Who can be a beneficiary of a trust?

Beneficiaries of a trust are the individuals or organizations who are entitled to receive the assets and income of the trust. Beneficiaries can be named in the trust document, or they can be designated by the settlor at a later date. Beneficiaries can include family members, friends, charities, or other organizations.

Who can be a beneficiary of a trust?

Beneficiaries of a trust are the individuals or organizations who are entitled to receive the assets and income of the trust. Beneficiaries can be named in the trust document, or they can be designated by the settlor at a later date. Beneficiaries can include family members, friends, charities, or other organizations.

What types of assets can be held in a trust?

Most types of assets can be transferred to a trust, including bank deposits, digital assets, stocks and shares, life insurance policies, real estate property, valuable collections, business interests etc.

What types of assets can be held in a trust?

Most types of assets can be transferred to a trust, including bank deposits, digital assets, stocks and shares, life insurance policies, real estate property, valuable collections, business interests etc.

What types of assets can be held in a trust?

Most types of assets can be transferred to a trust, including bank deposits, digital assets, stocks and shares, life insurance policies, real estate property, valuable collections, business interests etc.

What types of assets can be held in a trust?

Most types of assets can be transferred to a trust, including bank deposits, digital assets, stocks and shares, life insurance policies, real estate property, valuable collections, business interests etc.

How are remittances of foreign income/gains treated?

Most types of assets can be transferred to a trust, including bank deposits, digital assets, stocks and shares, life insurance policies, real estate property, valuable collections, business interests etc.

How are remittances of foreign income/gains treated?

Most types of assets can be transferred to a trust, including bank deposits, digital assets, stocks and shares, life insurance policies, real estate property, valuable collections, business interests etc.

How are remittances of foreign income/gains treated?

Most types of assets can be transferred to a trust, including bank deposits, digital assets, stocks and shares, life insurance policies, real estate property, valuable collections, business interests etc.

How are remittances of foreign income/gains treated?

Most types of assets can be transferred to a trust, including bank deposits, digital assets, stocks and shares, life insurance policies, real estate property, valuable collections, business interests etc.

Can a trust be amended or terminated?

In most cases, trusts can be amended or terminated by the settlor as long as they have the legal capacity to do so. However, certain types of trusts, such as irrevocable trusts, may not be amended or terminated by the settlor. In these cases, the terms of the trust must be followed as written.

Can a trust be amended or terminated?

In most cases, trusts can be amended or terminated by the settlor as long as they have the legal capacity to do so. However, certain types of trusts, such as irrevocable trusts, may not be amended or terminated by the settlor. In these cases, the terms of the trust must be followed as written.

Can a trust be amended or terminated?

In most cases, trusts can be amended or terminated by the settlor as long as they have the legal capacity to do so. However, certain types of trusts, such as irrevocable trusts, may not be amended or terminated by the settlor. In these cases, the terms of the trust must be followed as written.

Can a trust be amended or terminated?

In most cases, trusts can be amended or terminated by the settlor as long as they have the legal capacity to do so. However, certain types of trusts, such as irrevocable trusts, may not be amended or terminated by the settlor. In these cases, the terms of the trust must be followed as written.

Solutions

Corporate

INTEGRATIONS & CUSTOM SOLUTIONS

Disclaimer: The information provided on this website is for informational purposes only. It should not be considered legal, financial or tax advice. UTGL makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors, omissions or delays in this information or any losses, injuries or damages arising from its display or use. All information is provided on an as-is basis.

This website may contain links to external websites that are not provided or maintained by or in any way affiliated with UTGL. Please note that the UTGL does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites.

Links to external websites are provided as a courtesy and do not imply UTGL's endorsement of those sites or their content, products or services. UTGL assumes no liability for damages resulting from the use of or reliance upon the information provided herein.

Solutions

Corporate

INTEGRATIONS & CUSTOM SOLUTIONS

Disclaimer: The information provided on this website is for informational purposes only. It should not be considered legal, financial or tax advice. UTGL makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors, omissions or delays in this information or any losses, injuries or damages arising from its display or use. All information is provided on an as-is basis.

This website may contain links to external websites that are not provided or maintained by or in any way affiliated with UTGL. Please note that the UTGL does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites.

Links to external websites are provided as a courtesy and do not imply UTGL's endorsement of those sites or their content, products or services. UTGL assumes no liability for damages resulting from the use of or reliance upon the information provided herein.

Solutions

Corporate

INTEGRATIONS & CUSTOM SOLUTIONS

Disclaimer: The information provided on this website is for informational purposes only. It should not be considered legal, financial or tax advice. UTGL makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors, omissions or delays in this information or any losses, injuries or damages arising from its display or use. All information is provided on an as-is basis.

This website may contain links to external websites that are not provided or maintained by or in any way affiliated with UTGL. Please note that the UTGL does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites.

Links to external websites are provided as a courtesy and do not imply UTGL's endorsement of those sites or their content, products or services. UTGL assumes no liability for damages resulting from the use of or reliance upon the information provided herein.