PLANS

UTGL Supreme

UTGL Supreme

UTGL Supreme

Tailored for users seeking ultimate wealth and unmatched asset protection.

Tailored for users seeking ultimate wealth and unmatched asset protection.

Application Fee

$0*

*With injection over 500,000 USD or 15,000 USD application fee

Card Offer

1 complimentary physical World Elite Metal Asset Link Credit Card

Up to 5% USD cashback for cross border card transactions

Eligibility for invitation to apply for world’s first World Elite Ceramic Asset Link Credit Card

Max. 10 credit cards per account

Everything in Premium plan, plus

Set up a complementary SPV (Special Purpose Vehicle)

Unlimited beneficiaries

Fee and Waiver

15,000 USD application fee*

500 USD monthly fee**

*Waive application fee with an injection of 500,000 USD or more.

**Waive monthly fee with an average daily AUM of 500,000 USD or more between statement dates.

OVERVIEW

Supreme plan: Comprehensive asset management

The UTGL Supreme Plan is the ultimate solution for high-net-worth individuals seeking advanced asset protection and management. This plan delivers unparalleled features and benefits tailored to meet the complex financial needs of HNWIs.

Experience top-tier asset protection, flexible investment options, and exclusive benefits with the Supreme Plan. Trust and wealth planning at its finest.

Key Features

01

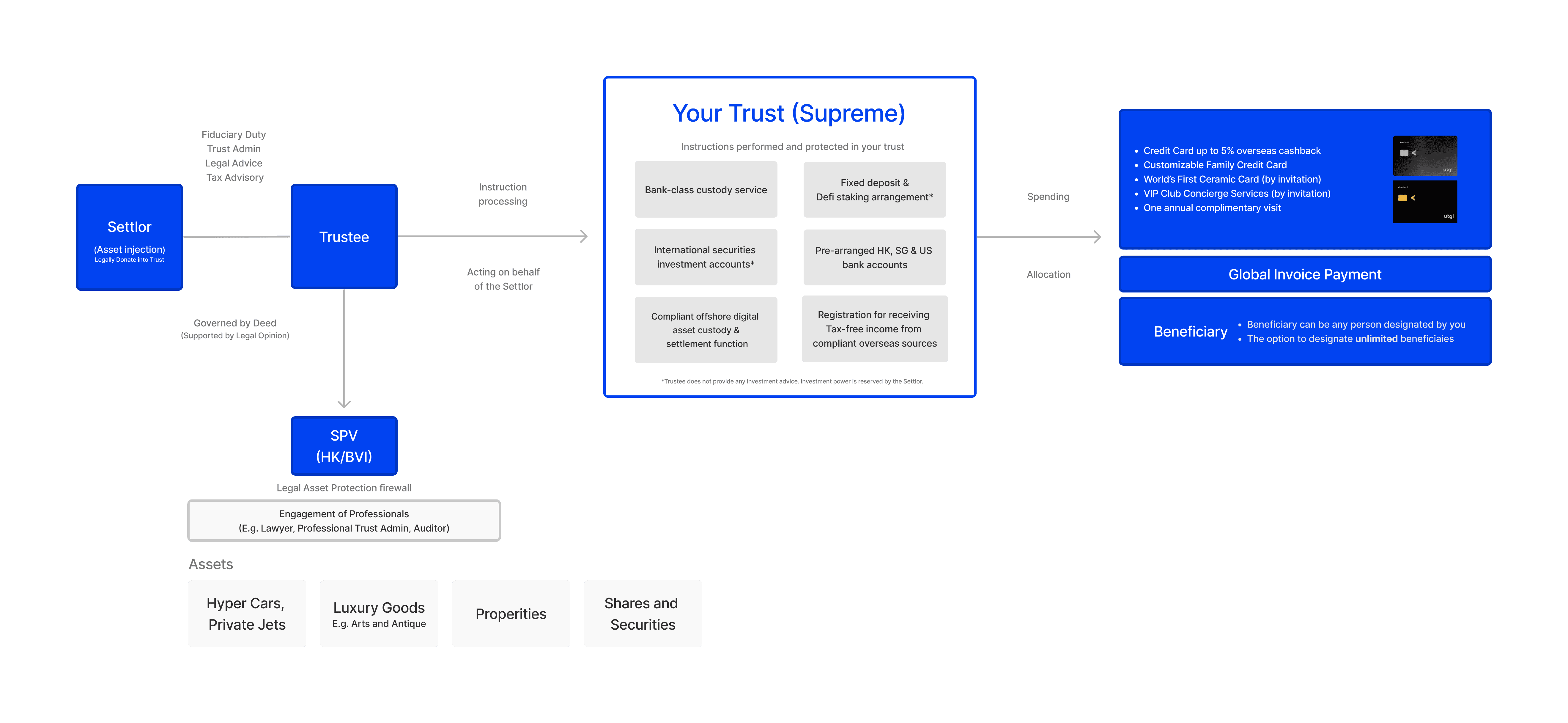

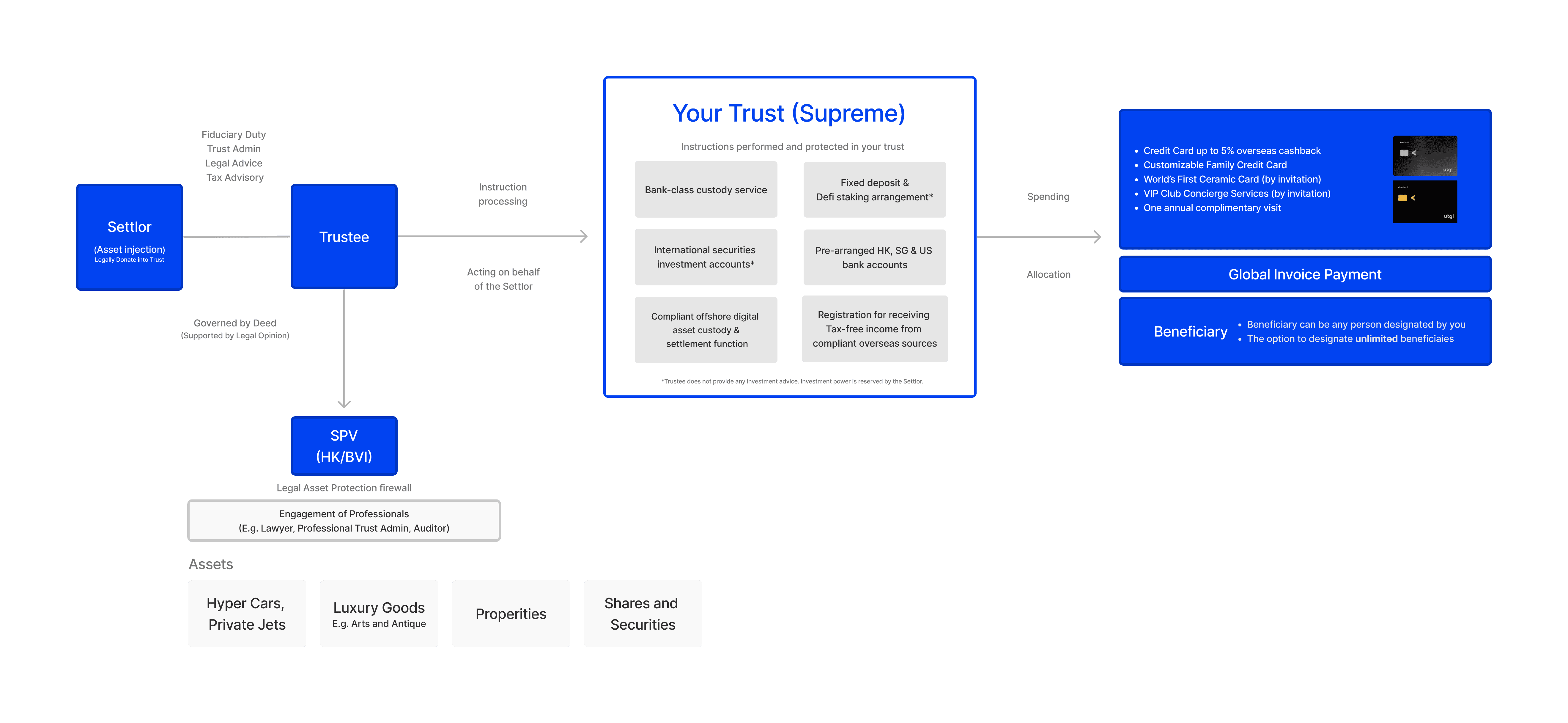

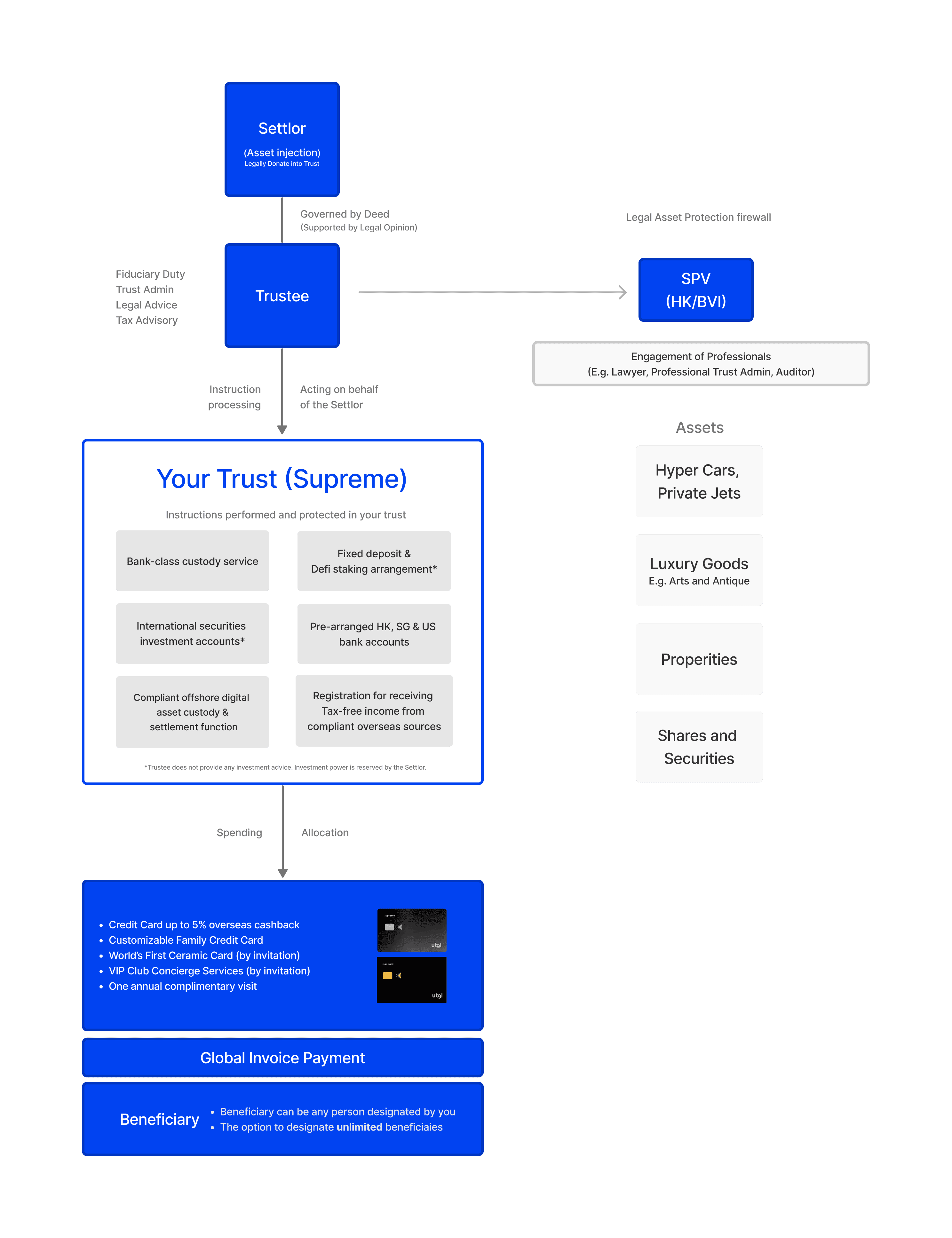

Special Purpose Vehicle (SPV) Structure: Enhanced legal protection through an HK company or a BVI company for your assets.

02

Diverse Asset Coverage: From finanical assets to non-financial assets.

03

Tax Optimization: Registration for receiving tax-free income from compliant sources.

04

World Elite Metal or Ceremic Black Credit Card: Up to 5% overseas cashback and exclusive perks.

05

Global Invoice Payment: Effortless international transactions.

06

Unlimited Beneficiary Designation: Maximum flexibility in estate planning.

07

Professional Team: You are served by experienced professionals, including trust specialists, dedicated customer service, legal experts, and compliance officers, ensuring top-notch service.

HOW IT WORKS

Leveraging the Supreme plan

Orchestrating comprehensive corporate wealth management.

CHOOSING PLAN

Is UTGL Supreme plan a good choice for me?

Ideal for HNWs who need tax planning and are not adequately served by banks due to the privacy or flexibility.

Comprehensive Financial Benefits

The plan offers tax benefits, asset segregation, and retaining full investment power.

Diverse Asset Support

It supports not only digital assets, cash, fiat, but also stocks, funds, bonds, insurance, precious metals, properties, motor vehicles, luxuries, art pieces and so on.

Tax Optimization and Regulatory Protection

The trust reduces tax burdens and to a certain extent reduce exposure in the financial and tax regulatory framework.

FREQUENTLY ASKED QUESTIONS

Everything you need to know

What is trust?

A trust is a legal arrangement in which an individual, known as the settlor, transfers ownership of their assets to a trustee, who is responsible for managing and distributing the assets according to the terms of the trust. Trusts can be used for a variety of purposes, including estate planning, asset protection, and wealth management.

What is trust?

A trust is a legal arrangement in which an individual, known as the settlor, transfers ownership of their assets to a trustee, who is responsible for managing and distributing the assets according to the terms of the trust. Trusts can be used for a variety of purposes, including estate planning, asset protection, and wealth management.

What is trust?

A trust is a legal arrangement in which an individual, known as the settlor, transfers ownership of their assets to a trustee, who is responsible for managing and distributing the assets according to the terms of the trust. Trusts can be used for a variety of purposes, including estate planning, asset protection, and wealth management.

Who can set up a trust?

Anyone can set up a trust, as long as they are of legal age and have the mental capacity to do so. Trusts can be set up by individuals or businesses, and they can be created for a variety of purposes.

Who can set up a trust?

Anyone can set up a trust, as long as they are of legal age and have the mental capacity to do so. Trusts can be set up by individuals or businesses, and they can be created for a variety of purposes.

Who can set up a trust?

Anyone can set up a trust, as long as they are of legal age and have the mental capacity to do so. Trusts can be set up by individuals or businesses, and they can be created for a variety of purposes.

Why do I need to name a beneficiary when setting up a trust with UTGL?

Naming a beneficiary is crucial. It provides clear instructions on how your assets should be distributed after your death, helps avoid the probate process, and allows you to maintain control over your legacy. Beneficiaries can be individuals (family, friends), organizations (charities, non-profits), other trusts, or minors (with a trustee appointed). UTGL requires the full name, contact numbers, passport and relationship of each beneficiary to execute the asset distribution when needed. Be aware of the limitations on the number of beneficiaries for each plan: Lite (0), Standard (1), Premium (2), and Supreme (unlimited). It is essential to review and update your beneficiary designations regularly, especially after significant life events such as marriages, divorces, births, or deaths.

Why do I need to name a beneficiary when setting up a trust with UTGL?

Naming a beneficiary is crucial. It provides clear instructions on how your assets should be distributed after your death, helps avoid the probate process, and allows you to maintain control over your legacy. Beneficiaries can be individuals (family, friends), organizations (charities, non-profits), other trusts, or minors (with a trustee appointed). UTGL requires the full name, contact numbers, passport and relationship of each beneficiary to execute the asset distribution when needed. Be aware of the limitations on the number of beneficiaries for each plan: Lite (0), Standard (1), Premium (2), and Supreme (unlimited). It is essential to review and update your beneficiary designations regularly, especially after significant life events such as marriages, divorces, births, or deaths.

Why do I need to name a beneficiary when setting up a trust with UTGL?

Naming a beneficiary is crucial. It provides clear instructions on how your assets should be distributed after your death, helps avoid the probate process, and allows you to maintain control over your legacy. Beneficiaries can be individuals (family, friends), organizations (charities, non-profits), other trusts, or minors (with a trustee appointed). UTGL requires the full name, contact numbers, passport and relationship of each beneficiary to execute the asset distribution when needed. Be aware of the limitations on the number of beneficiaries for each plan: Lite (0), Standard (1), Premium (2), and Supreme (unlimited). It is essential to review and update your beneficiary designations regularly, especially after significant life events such as marriages, divorces, births, or deaths.

Can a trust be amended or terminated?

In most cases, trusts can be amended or terminated by the settlor as long as they have the legal capacity to do so. However, certain types of trusts, such as irrevocable trusts, may not be amended or terminated by the settlor. In these cases, the terms of the trust must be followed as written.

Can a trust be amended or terminated?

In most cases, trusts can be amended or terminated by the settlor as long as they have the legal capacity to do so. However, certain types of trusts, such as irrevocable trusts, may not be amended or terminated by the settlor. In these cases, the terms of the trust must be followed as written.

Can a trust be amended or terminated?

In most cases, trusts can be amended or terminated by the settlor as long as they have the legal capacity to do so. However, certain types of trusts, such as irrevocable trusts, may not be amended or terminated by the settlor. In these cases, the terms of the trust must be followed as written.

Do I need to deposit assets before applying for this credit card?

No, you can apply online first. Assets can be deposited after you select a plan and provide the required documents.

Do I need to deposit assets before applying for this credit card?

No, you can apply online first. Assets can be deposited after you select a plan and provide the required documents.

Do I need to deposit assets before applying for this credit card?

No, you can apply online first. Assets can be deposited after you select a plan and provide the required documents.

Do I need to be a Hong Kong citizen to use your service?

No, you do not need to be a Hong Kong citizen to use our service. Non-citizens can apply by submitting their passport.

Do I need to be a Hong Kong citizen to use your service?

No, you do not need to be a Hong Kong citizen to use our service. Non-citizens can apply by submitting their passport.

Do I need to be a Hong Kong citizen to use your service?

No, you do not need to be a Hong Kong citizen to use our service. Non-citizens can apply by submitting their passport.

Can the card be sent to a country other than Hong Kong?

Yes, we can ship the card internationally. However, DHL Express does not deliver to the following countries: Ascension Bouvet Island British Indian Ocean Territory French Southern Territories Heard & McDonald Islands Pitcairn Saint Pierre & Miquelon Tajikistan Tristan Da Cunha US Minor Outlying Islands (Baker Island, Howland Island, Jarvis Island, Johnston Atoll, Kingman Reef, Midway Atoll, Palmyra Atoll, Wake Island) Western Sahara Additionally, DHL does not deliver to the following sanctioned countries: Belarus, Cuba, Iran, North Korea, Russia, Syria, and Ukraine.

Can the card be sent to a country other than Hong Kong?

Yes, we can ship the card internationally. However, DHL Express does not deliver to the following countries: Ascension Bouvet Island British Indian Ocean Territory French Southern Territories Heard & McDonald Islands Pitcairn Saint Pierre & Miquelon Tajikistan Tristan Da Cunha US Minor Outlying Islands (Baker Island, Howland Island, Jarvis Island, Johnston Atoll, Kingman Reef, Midway Atoll, Palmyra Atoll, Wake Island) Western Sahara Additionally, DHL does not deliver to the following sanctioned countries: Belarus, Cuba, Iran, North Korea, Russia, Syria, and Ukraine.

Can the card be sent to a country other than Hong Kong?

Yes, we can ship the card internationally. However, DHL Express does not deliver to the following countries: Ascension Bouvet Island British Indian Ocean Territory French Southern Territories Heard & McDonald Islands Pitcairn Saint Pierre & Miquelon Tajikistan Tristan Da Cunha US Minor Outlying Islands (Baker Island, Howland Island, Jarvis Island, Johnston Atoll, Kingman Reef, Midway Atoll, Palmyra Atoll, Wake Island) Western Sahara Additionally, DHL does not deliver to the following sanctioned countries: Belarus, Cuba, Iran, North Korea, Russia, Syria, and Ukraine.

How many days will it take to receive my card?

Once your card is ready, we will arrange delivery through DHL. Typically, it takes 5-7 business days for delivery to your address. You will receive a tracking link once the card is dispatched. Please note that delivery times may vary based on the shipping carrier and potential delays.

How many days will it take to receive my card?

Once your card is ready, we will arrange delivery through DHL. Typically, it takes 5-7 business days for delivery to your address. You will receive a tracking link once the card is dispatched. Please note that delivery times may vary based on the shipping carrier and potential delays.

How many days will it take to receive my card?

Once your card is ready, we will arrange delivery through DHL. Typically, it takes 5-7 business days for delivery to your address. You will receive a tracking link once the card is dispatched. Please note that delivery times may vary based on the shipping carrier and potential delays.

Can I directly apply for the Ceramic Black Card without an invitation?

No, direct applications for the Ceramic Black Card are not accepted. The card is exclusively available by invitation. Continue using your Metal Card to be considered for an upgrade.

Can I directly apply for the Ceramic Black Card without an invitation?

No, direct applications for the Ceramic Black Card are not accepted. The card is exclusively available by invitation. Continue using your Metal Card to be considered for an upgrade.

Can I directly apply for the Ceramic Black Card without an invitation?

No, direct applications for the Ceramic Black Card are not accepted. The card is exclusively available by invitation. Continue using your Metal Card to be considered for an upgrade.

How will I know if I am eligible for the Ceramic Black Card?

If you are eligible for the Ceramic Black Card, you will receive an invitation from us. There is no application process; eligibility is determined based on your spending with the Metal Card.

How will I know if I am eligible for the Ceramic Black Card?

If you are eligible for the Ceramic Black Card, you will receive an invitation from us. There is no application process; eligibility is determined based on your spending with the Metal Card.

How will I know if I am eligible for the Ceramic Black Card?

If you are eligible for the Ceramic Black Card, you will receive an invitation from us. There is no application process; eligibility is determined based on your spending with the Metal Card.

Who will hold the Special Purpose Vehicle (SPV)?

A trustee will hold the Special Purpose Vehicle (SPV) under your trust. This arrangement ensures that the SPV operates independently while providing several benefits in asset optimization.

Who will hold the Special Purpose Vehicle (SPV)?

A trustee will hold the Special Purpose Vehicle (SPV) under your trust. This arrangement ensures that the SPV operates independently while providing several benefits in asset optimization.

Who will hold the Special Purpose Vehicle (SPV)?

A trustee will hold the Special Purpose Vehicle (SPV) under your trust. This arrangement ensures that the SPV operates independently while providing several benefits in asset optimization.

How does a trustee manage the SPV?

A trustee manages the SPV by overseeing its operations, ensuring compliance with legal and regulatory requirements, and making decisions in the best interest of the trust’s beneficiaries. The trustee acts as a fiduciary, prioritizing the protection and optimization of the SPV’s assets.

How does a trustee manage the SPV?

A trustee manages the SPV by overseeing its operations, ensuring compliance with legal and regulatory requirements, and making decisions in the best interest of the trust’s beneficiaries. The trustee acts as a fiduciary, prioritizing the protection and optimization of the SPV’s assets.

How does a trustee manage the SPV?

A trustee manages the SPV by overseeing its operations, ensuring compliance with legal and regulatory requirements, and making decisions in the best interest of the trust’s beneficiaries. The trustee acts as a fiduciary, prioritizing the protection and optimization of the SPV’s assets.

Do you provide nominee services?

Yes. Our nominee services are designed to offer an extra layer of privacy and protection for your trust and assets. By using our nominee services, you can ensure that your personal information remains confidential while maintaining full control over your assets. Please contact us for more details on how our nominee services can benefit you.

Do you provide nominee services?

Yes. Our nominee services are designed to offer an extra layer of privacy and protection for your trust and assets. By using our nominee services, you can ensure that your personal information remains confidential while maintaining full control over your assets. Please contact us for more details on how our nominee services can benefit you.

Do you provide nominee services?

Yes. Our nominee services are designed to offer an extra layer of privacy and protection for your trust and assets. By using our nominee services, you can ensure that your personal information remains confidential while maintaining full control over your assets. Please contact us for more details on how our nominee services can benefit you.

Ready to get started?

Unlock the power of trust with UTGL today. Take the first step by exploring our Trust Platform or create an account for an instantly rewarding experience.

© 2025 UTGL. All rights reserved.

Disclaimer: The information provided on this website is for informational purposes only. It should not be considered legal, financial or tax advice. UTGL makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors, omissions or delays in this information or any losses, injuries or damages arising from its display or use. All information is provided on an as-is basis.

This website may contain links to external websites that are not provided or maintained by or in any way affiliated with UTGL. Please note that the UTGL does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites.

Links to external websites are provided as a courtesy and do not imply UTGL's endorsement of those sites or their content, products or services. UTGL assumes no liability for damages resulting from the use of or reliance upon the information provided herein.

Ready to get started?

Unlock the power of trust with UTGL today. Take the first step by exploring our Trust Platform or create an account for an instantly rewarding experience.

© 2025 UTGL. All rights reserved.

Disclaimer: The information provided on this website is for informational purposes only. It should not be considered legal, financial or tax advice. UTGL makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors, omissions or delays in this information or any losses, injuries or damages arising from its display or use. All information is provided on an as-is basis.

This website may contain links to external websites that are not provided or maintained by or in any way affiliated with UTGL. Please note that the UTGL does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites.

Links to external websites are provided as a courtesy and do not imply UTGL's endorsement of those sites or their content, products or services. UTGL assumes no liability for damages resulting from the use of or reliance upon the information provided herein.

Ready to get started?

Unlock the power of trust with UTGL today. Take the first step by exploring our Trust Platform or create an account for an instantly rewarding experience.

© 2025 UTGL. All rights reserved.

Disclaimer: The information provided on this website is for informational purposes only. It should not be considered legal, financial or tax advice. UTGL makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors, omissions or delays in this information or any losses, injuries or damages arising from its display or use. All information is provided on an as-is basis.

This website may contain links to external websites that are not provided or maintained by or in any way affiliated with UTGL. Please note that the UTGL does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites.

Links to external websites are provided as a courtesy and do not imply UTGL's endorsement of those sites or their content, products or services. UTGL assumes no liability for damages resulting from the use of or reliance upon the information provided herein.

Ready to get started?

Unlock the power of trust with UTGL today. Take the first step by exploring our Trust Platform or create an account for an instantly rewarding experience.

© 2025 UTGL. All rights reserved.

Disclaimer: The information provided on this website is for informational purposes only. It should not be considered legal, financial or tax advice. UTGL makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors, omissions or delays in this information or any losses, injuries or damages arising from its display or use. All information is provided on an as-is basis.

This website may contain links to external websites that are not provided or maintained by or in any way affiliated with UTGL. Please note that the UTGL does not guarantee the accuracy, relevance, timeliness or completeness of any information on these external websites.

Links to external websites are provided as a courtesy and do not imply UTGL's endorsement of those sites or their content, products or services. UTGL assumes no liability for damages resulting from the use of or reliance upon the information provided herein.