Nov 18, 2025

Table of Contents

UTGL Progressive Trust Establishment Model: Digital Wealth Management & Legacy Planning

Key Takeaways

Accessible Trust Planning: UTGL lowers entry barriers, making private trust solutions affordable and widely accessible.

Progressive Wealth Pathway: A step-by-step ladder supports clients from early-stage planning to UHNW family office structures.

Privacy & Asset Protection: Hong Kong-based structuring strengthens confidentiality, governance, and risk segregation (Trust + SPV).

Cross-Border Legacy Outcomes: Designed for global families seeking compliant wealth preservation, succession planning, and long-term continuity.

UTGL’s unique “Progressive Trust Establishment Model” revolutionizes traditional trusts by eliminating high entry barriers, rigid processes, and excessive costs. Powered by AI-driven automation and a fully digital financial system, a trust can be set up in as little as 15 minutes, delivering unprecedented convenience and efficiency. We are committed to democratizing and digitizing premium trust services, enhancing accessibility, flexibility, and transparency for clients at various wealth stages. UTGL’s model is designed to provide an accessible entry point for trust planning, enabling you to gradually inject assets into the trust as your wealth grows, without high costs depleting your initial capital, ensuring steady growth alongside you and your wealth.

UTGL Progressive Trust Establishment Ladder

Pre-Trust

Suitable for initial asset organization and management, ideal for ambitious individuals planning for the future, serving as a bridge to more structured trust arrangements and providing assurance for future asset planning.

UTGL’s universal trust concept offers a near-zero-cost, low-entry threshold, requiring only USD 120 or USD 10,000 in assets under management (AUM) to establish a Pre-Trust.

UTGL leverages digital tools and efficient processes to simplify the initial setup.

Assists clients in identifying initial needs, providing a clear roadmap, reducing participation costs, and laying a straightforward yet solid foundation for future wealth.

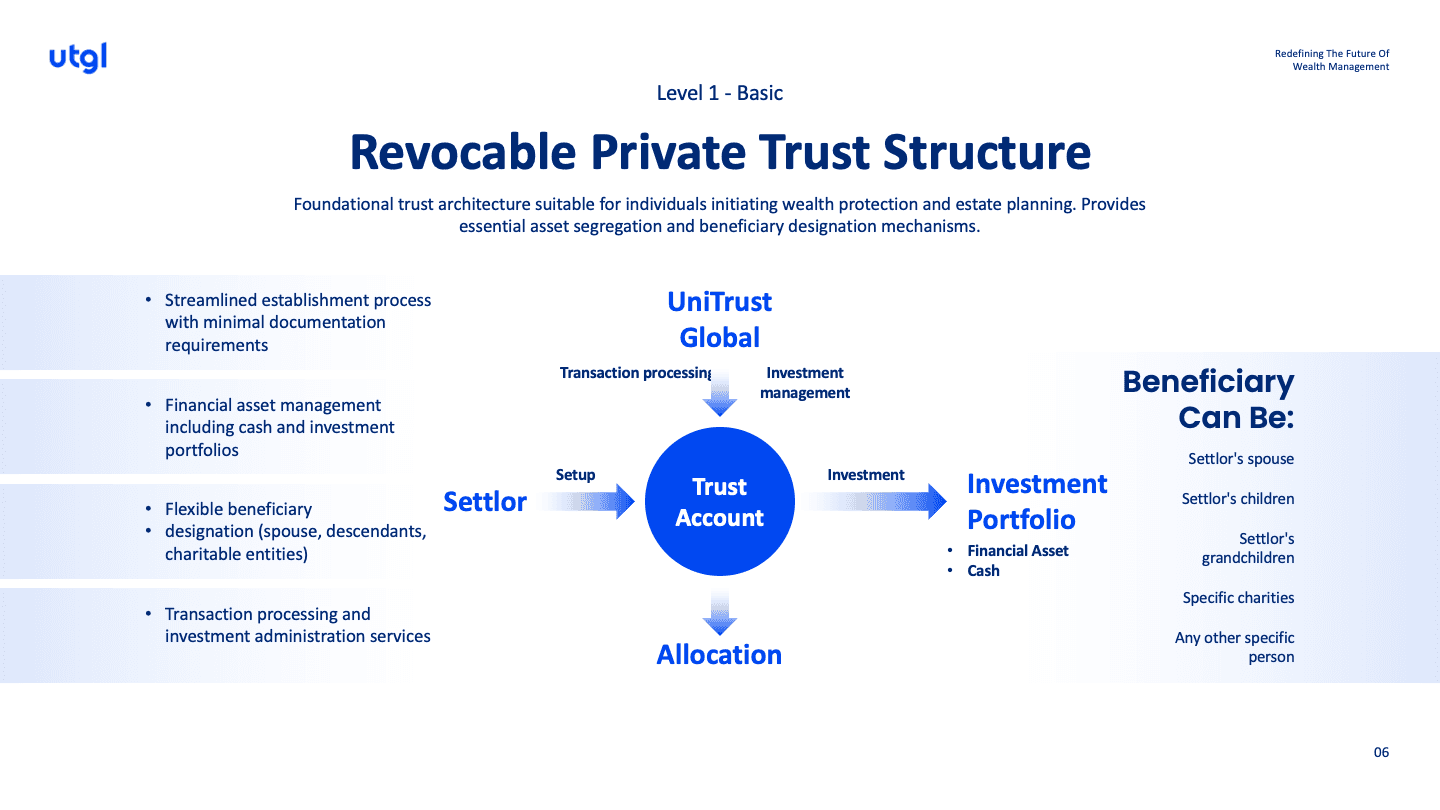

Private Living Trust (Revocable Living Trust)

Ideal for savvy middle-class or emerging high-net-worth individuals, offering high privacy, legal asset segregation, tax optimization, efficient estate distribution, and seamless, unlimited spending through a worry-free living trust solution.

Avoids the cumbersome probate process, allowing assets to be distributed directly according to your wishes without lengthy court procedures.

Robust flexibility, enabling you to adjust trust terms as needed at any time.

Progressive and affordable, with an entry threshold as low as USD 360 or USD 30,000 in assets under management (AUM) to establish a Revocable Living Trust.

Utilizes the Asset-Linked Credit Card to seamlessly connect trust assets with daily spending, enabling unlimited spending while enjoying cross-border wealth management and enhancing global asset liquidity.

Maximizes Hong Kong’s zero capital gains and inheritance tax advantages for efficient tax planning, reducing the tax burden on assets.

Eliminates reliance on traditional banking systems, enabling a bank-free lifestyle.

All trust assets are securely managed, ensuring flexible allocation, efficient operation under strict privacy, seamless financial management, and promoting wealth growth and preservation.

Offers a fully controllable and flexible digital management platform, allowing easy modification of trust terms, replacement of beneficiaries or trustees, or even revocation of the trust.

Efficiently avoids probate, ensuring assets are smoothly transferred into the trust for effective estate distribution.

Pre-designated successor trustees can quickly take over, ensuring continuity in asset management and enhancing privacy protection.

Provides the Asset Link Credit Card, increasing the liquidity of trust assets, globally accepted with no spending limit.

Maximizes Hong Kong’s zero capital gains and inheritance tax advantages for efficient tax planning, reducing the tax burden on assets and enabling a living without banking lifestyle.

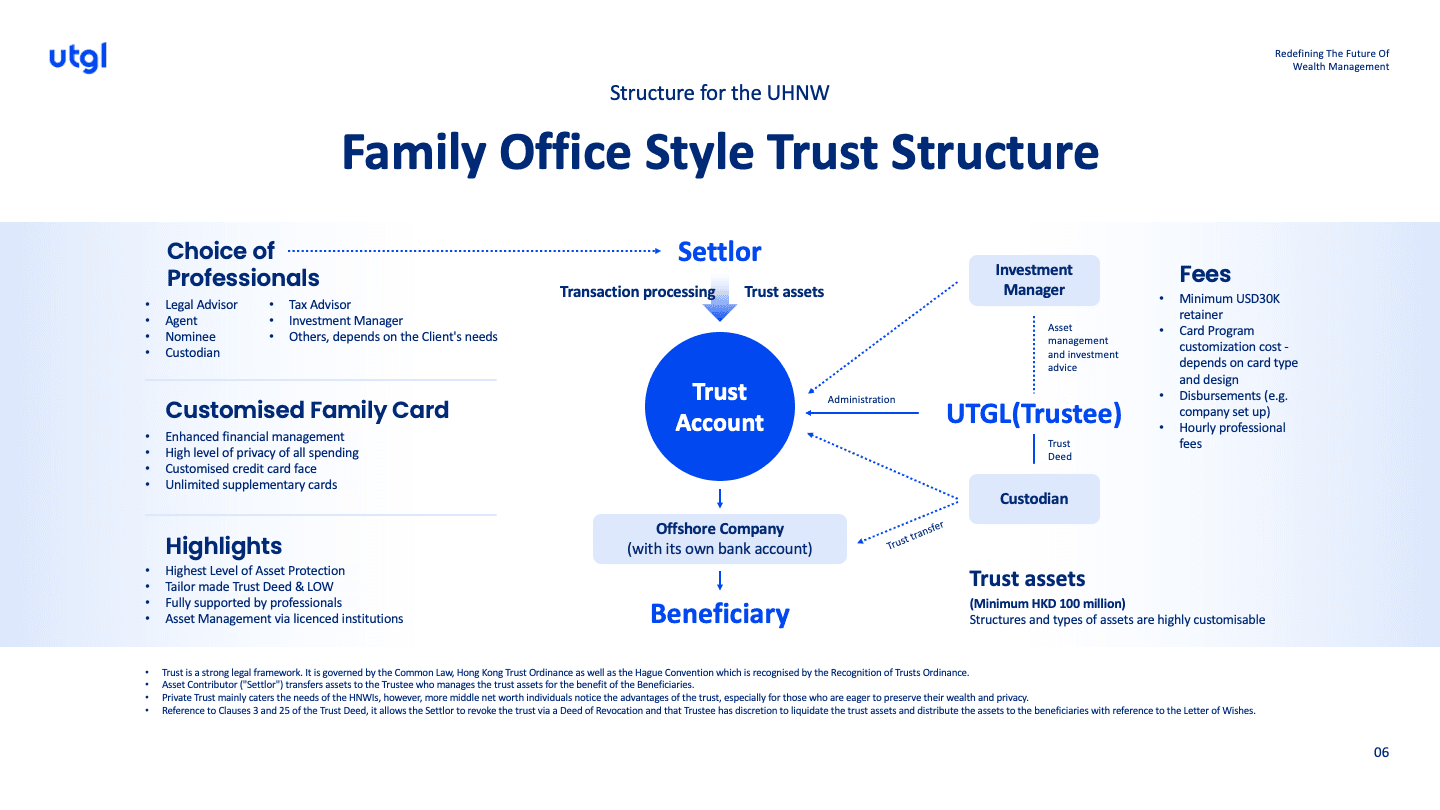

Family Office (Irrevocable Family Trust / Family Office)

Ideal for individuals at a stable life stage with assets exceeding USD 100 million, seeking the highest level of asset protection and multigenerational succession planning through an Irrevocable Trust Deed with absolute legal enforceability.

Tailored succession planning: UTGL designs personalized trust structures based on your inheritance plan, family circumstances, and vision, ensuring wealth is passed down according to your wishes.

Efficient wealth consolidation: Through establishing offshore entities to hold various non-financial assets, managed by professional trustees, UTGL effectively consolidates family wealth, significantly reducing management time costs.

Secured wealth succession: Ensures family wealth is strictly passed down to the next generation, or even further generations, according to the predetermined plan, avoiding potential inheritance disputes.

Asset protection: Leverages the legal enforceability of the irrevocable trust deed, combined with protections under Hong Kong’s Trustee Ordinance (Cap. 29), to effectively prevent asset freezes, legal disputes, and external threats, safeguarding family wealth.

Tax optimization: Combines UTGL’s fintech capabilities with a deep understanding of low-tax jurisdictions like Hong Kong to design trusts with robust asset protection and significant tax benefits, reducing tax burdens.

Privacy protection: UTGL’s trust services offer a high level of privacy protection, ensuring the confidentiality of family financial information.

Flexible asset management and growth: Through modern trust designs (e.g., trust protector mechanisms) and UTGL’s efficient management platform, mitigates the rigidity and opacity of traditional irrevocable trusts. UTGL preserves your capital, focusing on sustained asset growth based on your family’s investment strategy to ensure long-term wealth continuity.

Diverse trust instruments: Establishes special-purpose trusts (e.g., Special Needs Trust (SNT) or Irrevocable Life Insurance Trust (ILIT)) to meet clients’ specific succession needs.

Global investment opportunities: Unlocks the true growth potential of assets through global investment opportunities, achieving wealth appreciation.

Integrated wealth management: Leverages UTGL’s one-stop digital financial trust platform to seamlessly integrate various trust instruments into a comprehensive family wealth management framework, delivering all-encompassing, digital, and highly efficient solutions.

Asset Link Credit Card: UTGL’s Asset Link Credit Card enables family members to conveniently use trust assets for spending worldwide while maintaining a high level of privacy and security.

Long-term wealth growth: Achieves long-term, sustainable wealth succession and appreciation, building a centennial legacy for the family.

Conclusion

Trust structures and terms may be imitated by other institutions, but true trust stems from strength, compliance, and professionalism. As a publicly licensed and government-backed trust institution, we not only provide efficient asset management services but also strive to integrate legal safeguards, fintech innovation, and robust privacy protection, delivering comprehensive asset protection for every client. UTGL’s one-stop digital financial trust platform, powered by artificial intelligence and blockchain technology, ensures complete transparency and high security in asset management, enabling seamless transactions and 24/7 cross-border wealth management and tax optimization.

Whether you are establishing a trust for the first time or seeking to refine your asset planning, UTGL offers tailored solutions to meet your needs. We sincerely invite you to join us and embark on your trust journey, allowing us to provide long-term asset protection and wealth growth for you and your family. Choose UTGL and create the future of wealth succession together!

Contact UTGL now to experience the infinite possibilities of future trusts!

RELATED ARTICLES