Industries

Nov 19, 2022

Table of Contents

-Title

You should start investing as early as you can

Key Takeaways

Disclaimer: The content of this article is not investment advice, nor does it constitute any offer, solicitation, or suggestion for investment products. This information is for general purposes only.

Be friend with ‘Time’

Time can either be our best friend or our biggest enemy.

Time is a thief. It slips away without you even noticing. When it is gone, nothing is left.

Learning about time is the first lesson before we learn about investing. You can’t create more time or store it, you can only use it. How you use it determines whether time is your friend or your enemy.

Magic of compound interest

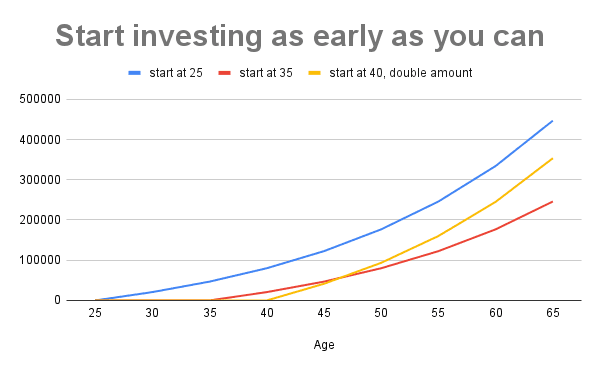

Here is an example to demonstrate how magical compound interest is and why you should start investing earlier.

Investor A: start investing US$300 (HK$2,330) per month at the age of 25

Investor B: start investing US$300 (HK$2,330) per month at the age of 35

Investor C: At the age of 40, he saves up a bit and starts investing US$600 (HK$4,660) per month at the age of 40

If we assume a respectable but reasonably conservative annual rate of return of 5%, here’s what happens to our three investors’ accounts at their 65:

From the graph, you can see that investor A who started investing at a young age, 25, has significantly earned a lot more than the one who started 5 years later, even though both of them were investing the same amount of money. It is noted that even if investor C wanted to catch up and invest double the amount of investors A and B did, he can never beat the one who started his investment at 25. IT IS THE POWER OF COMPOUND INTEREST.

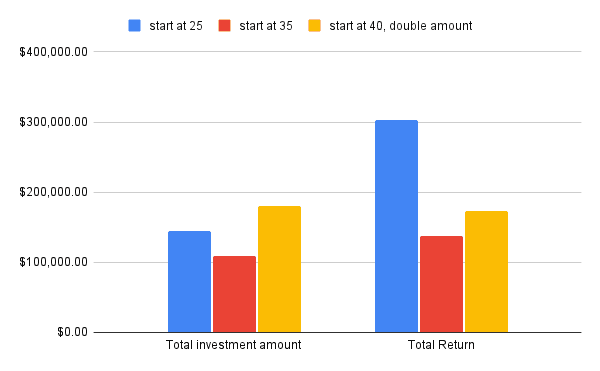

The left side shows the total investment amount of each investor until they are at the age of 65. The right side shows the total earnings of each investor.

Investor A earns more than double of his initial fund.

Invest B started 5 years later and can’t even earn half of what investor A earns.

Investor C tries his best to catch up but the total earning is still far less than investor A’s

Investor A, B and C, which one you want to be?

Nothing special the investor A did. He simply just started investing early and this could be YOU!

You may ask how do you achieve 5% annual return in the stock market?

In fact, according to global investment bank Goldman Sachs, 10-year stock market returns have averaged 9.2% over the past 140 years. Between 2010 and 2020, the investing firm even notes that the S&P 500 has done slightly better than the historic 10-year average, with an annual average return of 13.6% in the past 10 years.

Let’s look at three real life examples:

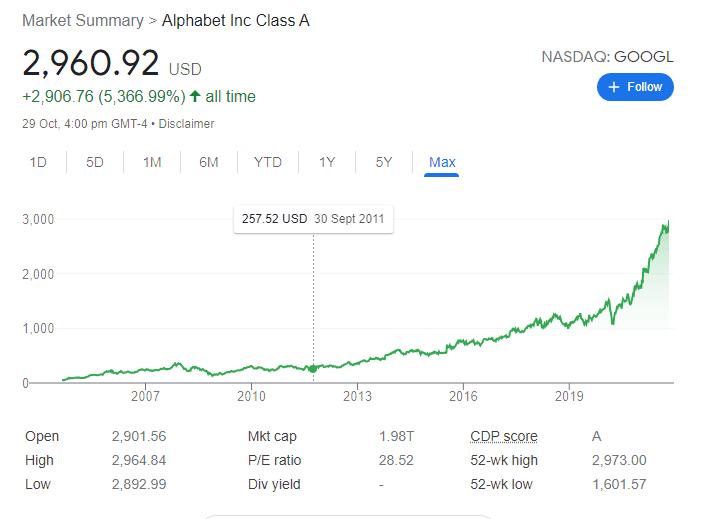

First one is Google (Stock code: GOOG)

Ten years ago, you purchased a share for USD$257.52, and now the stock price goes up to USD$2,960.92.

Calculate the simple return percentage:

Simple Return = (Current Price-Purchase Price) / Purchase Price

Now that you have your simple return, annualize it:

Annual Return = (Simple Return +1) ^ (1 / Years Held)-1

Using the formulas above, the annual return of the stock of Google is 27.66%.

If you invested US$10,000 (HK$77,855) in Google stock 10 years ago. You would have US$114,960 (HK$894,996) today.

Let’s look at the second stock as an example.

Amazon (stock code: AMZN)

Ten years ago, you purchased a share for USD$216, and now the stock price goes up to USD$3,372.

Using the same equation, the annual return of the stock of Amazon is 31.60%, which is even higher than Google’s annual return.

If you invested US$10,000 (HK$77,855) in Amazon stock 10 years ago. You would have US$155,797 (HK$1,212,919) today.

Let’s look at a company with an even longer history.

Nike (stock code: NKE)

Twenty years ago, you purchased a share for USD$5.98, and now the stock price goes up to USD$173.82.

The annual return over the past 20 years of the stock of Nike is 18.35%.

If you bought at US$5.98 with US$10,000 (HK$77,855) and held this stock for 20 years, you now would have US$290,646.60 (HK$2,262,756.44).

From the three real life examples above, you should realise how your friend, time, makes money for you. If you don’t make good use of your time, it will be gone without anything left for you. Therefore, start your long term investment as early as you can!

How? 5 steps to start your long term investment!

Step 1: Saving first

Emma is 25 years old. She graduated at 22 and has been working for 3 years now. Her monthly income is US$2,500 (HK$19,500) after tax. She has been saving up US$300 (HK$2,336) each month since she worked for 3 years. When she is 25, her investment pool is US$10,800 (HK$84,080) which is enough for her to buy some quality stocks.

There is no target amount of savings to start investment, but your investment choices will be limited if your investment pool is small. Moreover, all investments involve risks. It is not wise to put all your money in the stock market at one time. Therefore, save to build up your investment fund is the first step to invest!

Warren Buffett avoids unnecessary spending and once said, “Do not save what is left after spending, but spend what is left after saving.” “If you buy things you don’t need, you will soon sell things you need,” Buffett’s advice on saving.

Step 2: Create your trust

A Trust account of UTGL trust platform is an all-in-one account consisting of 4 different accounts (investment account, offshore account, credit card account, custodian account), which is highly protected by the Hague Convention and Trust Law. It is highly private and it can avoid freezing of assets. It is more powerful and reliable than a bank account.

With a trust account, you can do what global investors do. UTGL trust platform is connected to various high-standard financial trading platforms, covering US, European, Hong Kong, and Mainland China investment markets. You can select any securities broker to open one or more securities accounts depending on their products and fee schedules. Investment choices are no longer restricted by one firm and geographically, giving you 24-hour global investment opportunities.

When your investment fund is growing larger and larger in the next 10/20/30 years, asset protection can not be overlooked. Safekeeping your assets that you have grown (might be a million dollars or even more!) is also a principal reason why you should choose a secure trust account. Apart from giving you an ultra high level of privacy and protecting your investment fund from being frozen, a trust account also allows you to move your investment income to offshore accounts by just 1 click on the platform to have an extra layer of protection or spend your investment income globally with the UTGL Asset Link Credit Card on Mastercard brand. Your trust account also takes care of your loved ones after your passing by distributing the trust assets according to your wishes. For long term investment and wealth planning, a trust account is a powerful financial tool.

Opening an all-in-one trust account is a smart short-cut to manage all your accounts with just one password, so you have more time to study about investment and develop your career!

Step 3: Choose good companies

After setting up your trust account, it is time to study and choose the right companies to invest in. No idea which company to study?

No problem. Click here to read 100 US stocks we have filtered for you according to their steadily rising historical stock trends regardless the financial crisis in 2008 or covid-19 in 2020.

Step 4: Buy the stocks

It might take some time to choose the right companies. Making the right decision is always better than making a rush decision. For quality stocks, there is no best timing to buy. Whether you buy the stock at the lowest price will not affect your return to a great extent in the long term. Be confident in your analyses and the stocks you have bought. Hold them for at least 5 years.

Step 5: Review your investment portfolio

The climate is changing. The economy is changing. The world is changing. Let alone the listed companies in the stock market. Regularly review the listed companies in your investment portfolio. Have their business models changed? Are there any market rivals that appear to threaten their business? Is their performance on track of your expectations? Can the company adapt to the future and keep growing? After all, you might have to keep modifying your investment portfolio.

Key takeaway

The earlier you start investing, the more powerful the compound effect

For long term investment and wealth planning, a trust account is a powerful financial tool.